ADVERTISEMENT

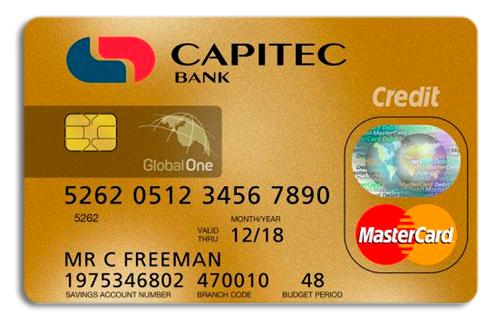

When you join Capitec’s financial universe, you gain access to benefits that transform your banking experience. The Capitec credit card offers advanced security features like fraud monitoring and two-factor authentication, ensuring your transactions are safe and convenient.

The Capitec credit card provides flexibility in managing your finances. The mobile app lets you track spending, transfer funds, and manage your account effortlessly.

ADVERTISEMENT

With competitive interest rates and various incentives, the Capitec credit card helps you maximize your money. This combination of security, flexibility, and rewards makes it a smart choice for enhancing your banking experience. Keep reading to discover how the Capitec credit card can revolutionize your financial journey.

About the Capitec:

Capitec Bank is one of the largest financial institutions in South Africa, known for its innovative and customer-centric approach. Founded in 2001, the bank quickly made a mark by offering simplified and accessible banking services. With a strong focus on technology, Capitec has become a leader in the digital banking sector.

ADVERTISEMENT

The bank operates with the mission of simplifying financial life for its clients by providing banking solutions that are straightforward, affordable, and transparent. Through its extensive network of branches and a robust digital platform, Capitec serves millions of customers across South Africa, delivering a modern and efficient banking experience.

In addition to traditional services, Capitec is recognized for its financial inclusion initiatives, offering banking products to a broad segment of the population. The bank is committed to security and continuous innovation, ensuring that clients always have access to the best financial tools available.

Card Benefits

Advanced Security Features: Fraud monitoring and two-factor authentication ensure your transactions are safe and secure.

Financial Flexibility: Manage your finances effortlessly through the mobile app, track spending, transfer funds, and manage your account. You can also block your card instantly if lost or stolen.

Cashless Payments and Zero Fees: Enjoy cashless payments with zero fees worldwide at Mastercard® card machines, online, and for telephone and mail orders. Plus, benefit from no currency conversion fees for international payments.

Financial Rewards: Earn up to 1% cash back on your spending and competitive interest rates on a positive balance.

Interest-Free Period: Up to 55 days interest-free on purchases if you pay your balance in full.

Credit Building: Helps improve your credit score with responsible usage.

Travel Insurance: Free travel insurance up to R5 million when you book flights with your Capitec credit card.

Payment Flexibility: Choose between straight and budget payment options, giving you up to 48 months to repay purchases.

Capitec Fees and Commissions

The Capitec credit card comes with an initiation fee of R100 and a monthly fee of R50. The interest rate ranges from 11.75% to 22.25% based on your credit profile. You can enjoy up to 55 days interest-free if you pay the full outstanding balance before the next installment due date. The minimum monthly payment is 5% of the outstanding balance.

There are no currency conversion fees for international payments, and you get free delivery of the credit card, free local swipes, and free travel insurance up to R5 million. Additional benefits include up to R500,000 in credit, 1% cash back on spending, and 3.5% interest per year on a positive balance. Free payment protection, lost card, and travel insurance are also included.

Please note that Capitec reserves the right to change fees and commissions at any time without prior notice. For the most current information, always refer to the official Capitec Bank website.

Positive points

- Advanced Security:The Capitec credit card features advanced security measures including fraud monitoring and two-factor authentication, ensuring safe transactions.

- No Currency Conversion Fees:Ideal for international travel and online shopping abroad, as there are no fees for currency conversion.

- Competitive Interest Rates and Rewards:Offers competitive interest rates and up to 1% cash back on spending, along with 3.5% interest on a positive balance.

Negative points

- High Interest Rates for Some Users:The interest rates can be as high as 22.25%, depending on your credit profile, which can be a disadvantage for some users.

- Income Requirement:The minimum income requirement of R5,000 per month may exclude some potential applicants.

- Monthly and Initiation Fees:The card comes with a R100 initiation fee and a monthly fee of R50, which could add up over time.

Credit card limit

The Capitec credit card offers a credit limit of up to R500,000, tailored to your financial profile and affordability. This generous limit provides significant financial flexibility, accommodating a wide range of spending needs, from everyday purchases to larger, more significant expenses.

With such a high credit limit, the Capitec credit card is designed to support various financial goals, ensuring you have the necessary credit available when you need it. This makes it an ideal choice for those seeking both financial flexibility and security.

How to apply for Capitec

Complete the Online Application Form: Fill in the required personal and financial information. Upload the necessary documents.

Submit Application: Review your information and submit the application.

Approval Process: Capitec will review your application and documents. You will be informed about the approval status and credit limit.

Card Delivery: Once approved, your credit card will be delivered to your specified address or can be collected from the branch.

How to contact Capitec

To contact Capitec, you can use the following information:

- Phone: 0860 10 20 43 (within South Africa) / International: +27 21 941 1377

- Email: [email protected]