ADVERTISEMENT

Choosing a no monthly fee credit card can lead to substantial savings, helping you avoid unnecessary expenses each month. These cards often come with attractive perks, making them an appealing option for savvy consumers seeking financial efficiency.

Navigating the numerous options can be daunting, but we’re here to simplify the process. Below, we’ve outlined five outstanding no monthly fee credit cards, each with unique benefits tailored to various needs. Explore these options to find the perfect card for your financial goals!

ADVERTISEMENT

FNB Easy Zero Debit Card

About the Card

ADVERTISEMENT

The FNB Easy Zero Debit Card is a basic transactional account designed for everyday banking needs. This card is perfect for those who seek simplicity and cost-effectiveness in their banking solutions, providing essential features without unnecessary frills.

Main Benefits

- No monthly fees: Ensure every penny goes further.

- Free ATM withdrawals: Add convenience to your banking.

- Digital banking access: Enjoy modern and efficient financial management.

Absa Student Credit Card

About the Card

The Absa Student Credit Card is specifically tailored for students, offering a range of benefits to help manage finances effectively. It provides young adults with an opportunity to build their credit history while enjoying student-friendly features.

Main Benefits

- No monthly fees: Ideal for a student’s budget.

- Budgeting tools and financial advice: Manage expenses effectively.

- Reward points for purchases: Make everyday spending more rewarding.

Standard Bank Kids Card

About the Card

The Standard Bank Kids Card is a fantastic tool to teach children about money management from an early age. This card helps parents instill financial responsibility in their kids, providing a safe and controlled environment for learning about personal finance.

Main Benefits

- No monthly fees: Affordable for families.

- Parental control features: Monitor and guide spending.

- Savings incentives: Encourage good financial habits.

Bidvest Bank World Currency Card

About the Card

The Bidvest Bank World Currency Card is a prepaid travel card that allows you to load multiple currencies for convenient international travel. This card is ideal for frequent travelers who want to avoid the hassle of carrying multiple foreign currencies or dealing with fluctuating exchange rates.

Main Benefits

- No monthly fees: Cost-effective travel finance.

- Lock in exchange rates: Protect against currency fluctuations.

- Accepted worldwide: Enjoy the convenience of a globally recognized payment method.

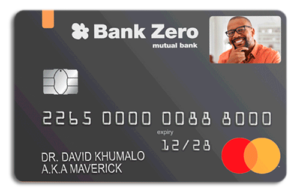

Bank Zero Debit Card

About the Card

The Bank Zero Debit Card offers a modern banking experience with no monthly fees, focusing on digital innovation and user-friendly features. This card is perfect for tech-savvy individuals who prefer managing their finances through advanced digital platforms.

Main Benefits

- No monthly fees: Keep banking costs to a minimum.

- Full control via mobile app: Seamless and intuitive user experience.

- Competitive interest rates on savings: Grow your money efficiently.

Comparing card features

When evaluating no monthly fee cards, it’s crucial to compare the exclusive benefits each card offers. The FNB Easy Zero Debit Card provides free ATM withdrawals and digital banking access, ensuring efficient financial management. The Absa Student Credit Card offers reward points for everyday purchases and access to budgeting tools and financial advice tailored for students.

The Standard Bank Kids Card features parental control options to monitor and guide spending, along with savings incentives to encourage good financial habits in children. The Bidvest Bank World Currency Card allows you to lock in exchange rates to avoid currency fluctuations and enjoy the convenience of a globally accepted payment method. Lastly, the Bank Zero Debit Card provides full control via a mobile app and competitive interest rates on savings.

Understanding these unique features will help you determine which card offers the most value for your specific needs. Additionally, consider the customer service reputation of the card issuer. A responsive and helpful support team can significantly enhance your overall experience. By thoroughly comparing these features, you can ensure that you choose a card that aligns perfectly with your financial goals and lifestyle.

Choosing the best no monthly fee card

No monthly fee cards can significantly reduce your banking costs, providing more financial freedom. Evaluate the options carefully and choose a card that not only saves you money but also offers the features and benefits most important to you.

With the right card, you can enjoy the convenience and advantages of modern banking without the burden of monthly fees. Take your time to explore your options and select a card that will best support your financial journey, offering both savings and value.