ADVERTISEMENT

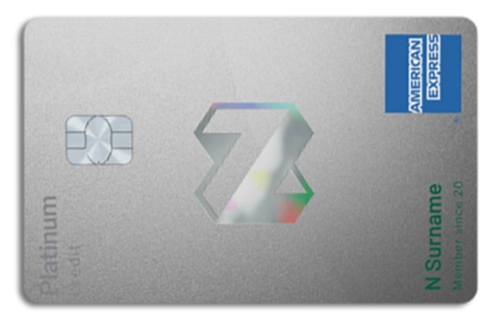

The Nedbank Platinum Credit Card is the ideal choice for those seeking exclusivity and superior benefits. With advantages ranging from VIP lounge access to an attractive rewards program, this card offers a premium banking experience.

Additionally, the card provides advanced security with cutting-edge technology, ensuring peace of mind in all transactions. The 24/7 customer support ensures immediate assistance whenever needed.

ADVERTISEMENT

Discover below all the details of the Nedbank Platinum Credit Card and see how it can elevate your banking experience. Learn how to apply for your card and enjoy all the benefits it has to offer!

About the Nedbank:

Nedbank is a premier financial institution in South Africa, renowned for its innovation and commitment to customer satisfaction. With a strong market presence, the bank offers a wide range of financial services, from personal and business banking to wealth management and investments, ensuring comprehensive support for its clientele.

ADVERTISEMENT

Nedbank’s customer-centric approach prioritizes personalized banking solutions, supported by user-friendly digital platforms and an extensive network of branches and ATMs for easy access. By leveraging the latest financial technology, the bank enhances both security and convenience, providing a seamless banking experience.

Built on trust and reliability, Nedbank’s mission is to exceed customer expectations with high-quality services and innovative products. Through continuous investment in technology and a focus on customer needs, Nedbank remains a top choice for individuals and businesses seeking superior banking services in South Africa.

Card Benefits

Concierge Services: Receive personalized assistance for reservations, event planning, and more, making your life easier and more convenient. Whether you need to book a restaurant, plan a special event, or require travel arrangements, the concierge service is at your disposal to handle all the details, providing you with more time to focus on what matters most.

Purchase Protection: Get coverage against damage and theft of eligible purchases, providing additional security for your valuable items. This benefit ensures that your purchases are protected from unforeseen circumstances, offering peace of mind when shopping for high-value items.

Lifestyle Benefits: Enjoy exclusive discounts on events, dining, and experiences, enhancing your lifestyle with premium offers. These benefits allow you to experience the best in entertainment and dining, with special offers and discounts that add value to your daily life.

Financial Management: Utilize online tools to manage your finances efficiently, helping you stay on top of your budget and expenses. With features like spending analysis, budgeting tools, and account alerts, you can have a clear view of your financial health and make informed decisions.

Price Protection: Take advantage of price protection that reimburses the difference if you find a lower price on an item you purchased. This benefit ensures that you always get the best deal possible, giving you confidence in your purchases and protecting your financial interests.

Nedbank Platinum Fees and Commissions

The Nedbank Platinum Credit Card charges a monthly service fee of R67. Additionally, there is a credit facility fee starting from R32 per month. These fees cover the cost of maintaining your credit account and providing various card benefits.

One of the key advantages of this card is that there are zero charges on card swipes, allowing you to make purchases without additional transaction fees. This makes it a cost-effective option for everyday use.

Please note that fees may be adjusted without prior notice. Always refer to the terms and conditions for the most up-to-date information.

Positive points

- VIP Lounge Access:Superior travel experience.

- Attractive Rewards:Points on all purchases.

- Advanced Security:Robust fraud protection.

Negative points

- Monthly service:Monthly service fee of R67.

- Variable Interest Rates:Can be high depending on credit profile.

- Eligibility Criteria:Strict approval criteria.

Credit card limit

The credit limit of the Nedbank Platinum Credit Card is personalized according to the applicant’s credit analysis. This means that each cardholder’s limit is tailored to their financial situation and creditworthiness, ensuring a customized credit experience.

Nedbank also conducts periodic reviews of the credit limit, taking into account the client’s usage behavior, payment history, and changes in their financial profile. This allows for adjustments to the credit limit, providing more purchasing power or managing risk, and ensuring that clients always have a credit limit that matches their current financial circumstances.

How to apply for Nedbank Platinum

- Visit the official Nedbank website.

- Navigate to the Nedbank Platinum Credit Card page.

- Click on “Apply Now.”

- Fill out the form with your personal and financial information.

- Review and submit your application.

- Wait for your application to be reviewed and approved.

How to contact Nedbank

For more information or assistance, contact Nedbank customer service:

- Phone: 0800 555 111

- Email: [email protected]

Apply your Nedbank Platinum Credit Card and start enjoying a premium banking experience with exclusive advantages and advanced security!