ADVERTISEMENT

Online cash loans can be a helpful financial tool, but it’s essential to understand how they fit into your overall financial plan.

Before applying, assess your current financial situation. Make a list of your income, expenses, and any existing debts to see how much additional debt you can realistically manage.

ADVERTISEMENT

When considering an online cash loan, research different lenders to find the best terms.

Look for lenders with positive reviews and transparent information about fees and rates.

ADVERTISEMENT

Comparing multiple offers can help you save money and avoid scams that are common in the online lending space.

Finally, think about your repayment strategy before taking out a loan. Create a budget that includes your loan payments and stick to it.

This will help prevent missed payments and potential financial trouble down the line. Being proactive about your financial plan can lead to a more secure financial future.

Are you in urgent need of cash? Online cash loans provide an easy solution to access funds quickly when traditional lending falls short.

With just a few clicks, you can apply online and receive cash right away, making them perfect for unexpected expenses or emergencies.

Understanding Online Cash Loans

Online cash loans are short-term loans that you can apply for through the internet.

They are designed to provide quick cash for unexpected expenses or emergencies.

The application process is simple and can often be completed in just a few minutes, making them a convenient option for many people.

One of the main advantages of online cash loans is that they can be accessed from the comfort of your own home.

You don’t need to visit a bank or lender in person, which saves you time and effort.

Many lenders also offer flexible repayment plans, allowing you to choose terms that fit your financial situation.

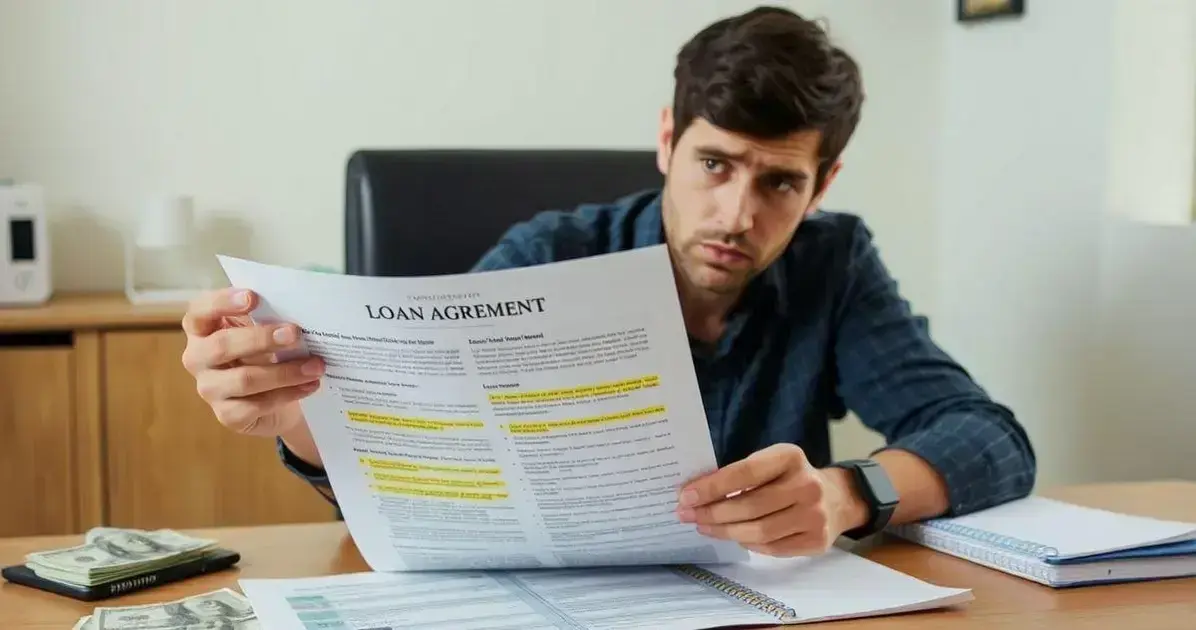

However, it’s essential to understand the costs associated with online cash loans.

While they provide fast access to money, they often come with higher interest rates compared to traditional loans.

It’s crucial to read the terms and conditions carefully to understand how much you will pay back over time.

Benefits of Online Cash Loans

One of the key benefits of online cash loans is their speed.

Unlike traditional loans, where approval may take days or even weeks, online cash loans can often be approved within minutes.

This means you can get the cash you need quickly, making it perfect for emergencies like car repairs or medical bills.

Another significant advantage is the convenience they offer. You can apply for these loans 24/7 from anywhere with an internet connection.

There is no need to travel to a bank or wait in long lines. This accessibility makes online cash loans a popular choice for people with busy schedules.

Additionally, many online lenders have a straightforward application process.

You typically only need to provide basic information, like your income and identification.

This simplicity reduces stress and makes it easy for almost anyone to apply and receive approval.

How to Apply for Online Cash Loans

Applying for online cash loans is a straightforward process that you can complete from your home.

First, visit a reputable lender’s website and fill out the online application form.

You will need to provide personal information, such as your name, contact details, and income. Ensure all information is accurate to avoid delays in processing your application.

Once you submit your application, the lender will review it quickly. Many lenders use automated systems that can give you an answer almost immediately.

If approved, you will receive a loan offer outlining the amount, interest rate, and repayment terms. Take your time to read this information carefully before accepting the loan.

After accepting the offer, you will need to sign the loan agreement electronically.

Then, the lender will usually transfer the approved funds to your bank account within one business day.

Make sure you know when repayments start and keep track of your payments to avoid any issues.

Requirements for Online Cash Loans

To apply for online cash loans, there are a few basic requirements that you must meet.

First, you usually need to be at least 18 years old and a legal resident of the country where you apply.

Most lenders also require you to have a steady source of income, whether from a job, benefits, or self-employment, to ensure you can repay the loan.

Additionally, you will need to provide some form of identification. This may include a driver’s license, ID card, or social security number.

Some lenders might also ask for your bank account details so they can process the loan transfer and repayment more efficiently.

Lastly, it’s important to have a good credit standing, though not all lenders have strict credit checks.

If you have a lower credit score, you might still qualify, but be prepared for higher interest rates.

Always check the specific requirements of the lender you choose to ensure you meet their needs.

Types of Online Cash Loans

There are several types of online cash loans available to meet different financial needs.

One common type is a personal loan, which gives you a lump sum of cash that you can use for various purposes, such as paying bills or making a purchase.

Personal loans typically have fixed interest rates and set repayment terms, making budgeting easier.

Another type is a payday loan, designed for short-term borrowing until your next paycheck.

These loans usually come with a higher interest rate but are quick and easy to access.

They are best for covering immediate expenses but should be used carefully to avoid high fees.

Lastly, there are installment loans, which allow you to borrow a sum and pay it back in smaller, scheduled payments over time.

This option can provide a more manageable way to repay your debt compared to the lump-sum payments of personal and payday loans.

Always consider your financial situation before choosing a loan type that fits your needs.

Comparing Online Cash Loans Providers

When comparing online cash loans providers, it is essential to look at several key factors. One of the most important aspects is the interest rate.

Different lenders offer different rates, which can significantly impact how much you will repay.

Make sure to read the fine print and understand the total cost of the loan before making a decision.

Another factor to consider is the loan terms and repayment options.

Some providers may offer flexible repayment schedules, while others may require strict monthly payments.

It’s a good idea to find a lender that offers terms that suit your financial situation and lifestyle to ensure you can manage the payments comfortably.

Lastly, read customer reviews and ratings for each lender. This can give you insights into their customer service and reliability.

A provider with positive feedback and good customer support can make your borrowing experience much smoother and more pleasant.

Repaying Your Online Cash Loan

Repaying your online cash loan is an important part of the borrowing process. First, make sure you know the repayment schedule.

Most loans have set dates when payments are due, and it’s essential to stay on track to avoid late fees.

Setting reminders on your phone or calendar can help you keep track of these dates.

It’s also wise to know how your payments are being applied. Typically, part of your payment goes toward the interest and part goes to the principal amount you borrowed.

Understanding this breakdown can help you see how your loan balance decreases over time, which can be motivating.

If you find that you can pay off your loan early, check if there are any prepayment penalties.

Some lenders allow this without extra fees, and paying off your loan sooner can save you money on interest.

Always review your loan agreement to ensure you’re making the best decision for your financial situation.

Common Mistakes to Avoid

When taking out online cash loans, one common mistake is not reading the terms and conditions thoroughly.

Many borrowers skip this step and later find hidden fees or unfavorable repayment terms.

Always take the time to understand the loan details, including interest rates, fees, and penalties, so you are fully aware of what you’re committing to.

Another mistake is borrowing more money than needed.

Some individuals think they should take out the maximum amount available to them, but this can lead to larger repayments and increased debt.

Instead, carefully assess your financial situation and borrow only what you truly need to cover your expenses.

Finally, not considering your payment strategy can lead to financial trouble.

Failing to plan how you will make your repayments may result in missed payments, late fees, and damaged credit.

Before you take a loan, think about your income and expenses to ensure you can comfortably manage the repayments.

Alternatives to Online Cash Loans

If you’re looking for alternatives to online cash loans, one option is a personal loan from a bank or credit union.

These loans often have lower interest rates compared to online lenders, especially for borrowers with good credit.

A personal loan can provide a larger sum of money with a longer repayment period, making it a more manageable choice for many.

Another alternative is borrowing from family or friends. While it may be uncomfortable, this option can come with little to no interest and flexible repayment terms.

Just be sure to communicate clearly and set a repayment plan to avoid misunderstandings and strain on relationships.

Finally, you might consider local community programs or non-profit organizations that offer financial assistance.

Many communities have programs designed to help individuals in need with no-interest loans or grants.

Researching these can offer a safe and responsible way to get financial help without the high costs associated with online cash loans.