ADVERTISEMENT

Smart investment strategies are essential for financial growth. They empower individuals to make informed decisions. Adopting these strategies can lead to wealth creation.

With the right approach, your investment portfolio can flourish. Understanding market trends and asset allocation is crucial for success. Knowledge is your greatest ally in this journey.

ADVERTISEMENT

Understanding Smart Investment Strategies

Understanding smart investment strategies starts with knowing what investing really means.

It’s about using your money to buy things that can grow in value, like stocks or real estate. The goal is to make your money work for you and not the other way around.

ADVERTISEMENT

Smart investing means having a plan. You need to think about your goals and how long you want to invest.

Some people save for a house, retirement, or their children’s education. Knowing your goals makes choosing the right investment easier.

Another important part of smart investment strategies is research. Understanding the market trends and the companies you invest in can help you make better choices.

The more you know, the more confident you’ll be in your decisions.

Key Principles of Smart Investing

Key principles of smart investing include understanding risk and reward. All investments come with some risk, but the potential reward can be greater.

Knowing how much risk you are willing to take helps you make smarter choices.

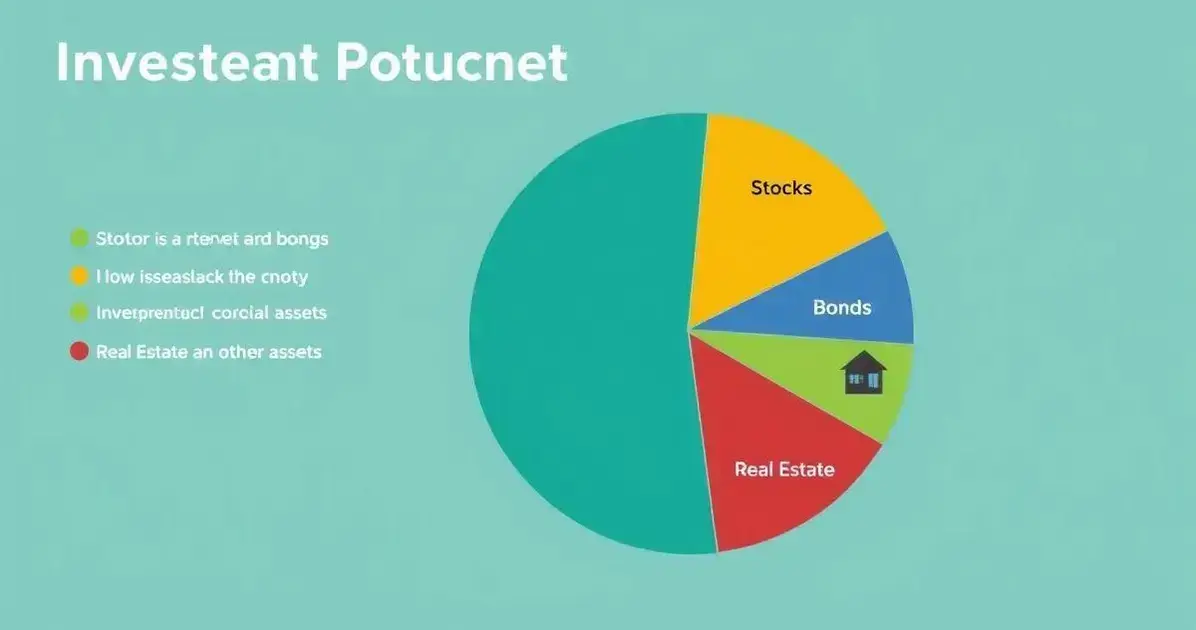

Diversification is another important principle. By spreading your investments across different areas, like stocks, bonds, and real estate, you lower the chance of losing money.

This way, if one part of your investment does not do well, others may do better.

Lastly, it’s important to have patience. Smart investing is not about making quick money.

It’s about holding your investments for the long term and allowing them to grow. Staying focused on your goals will keep you on track.

Long-term vs Short-term Investments

Long-term investments are for those who think ahead. They involve putting your money into assets like stocks or real estate and holding onto them for several years.

This approach allows you to ride out market ups and downs, often leading to greater rewards over time.

Short-term investments, on the other hand, focus on quick returns. These might include day trading or buying and selling stocks frequently.

While they can provide fast profits, they also come with higher risks, especially if the market changes unexpectedly.

Choosing between long-term and short-term investments depends on your financial goals. If you want to grow your wealth slowly and steadily, long-term is the way to go.

If you’re looking for quick gains, short-term might appeal to you. Understanding the trade-offs is key to making smart choices.

Diversification: Spreading Your Risk

Diversification is an important strategy for reducing risk in your investments.

By spreading your money across different types of assets, like stocks, bonds, and real estate, you lessen the impact if one investment does poorly. This helps protect your overall wealth.

Imagine not putting all your eggs in one basket. If one part of your investment falls, others may still perform well.

This balance can lead to more stable returns over time, making diversification a key part of smart investing.

It’s also essential to diversify within each asset type. For example, when investing in stocks, consider companies from various industries.

This way, you decrease the chance of losing money if one industry faces challenges. Always remember, spreading your risk can lead to greater financial peace of mind.

Tools and Resources for Smart Investing

Having the right tools for smart investing can make a big difference in your financial journey.

Investment apps and online platforms allow you to track your portfolio and manage your investments easily.

Tools like these help you stay informed and make quick decisions.

Research is essential, and many websites provide valuable information and analysis. Financial news sites and investment blogs can keep you updated on market trends.

You can also use stock screeners to find the best investment options based on your goals.

Finally, consider learning from experts. Books, podcasts, and online courses can offer insights and strategies that improve your investing skills.

Gaining knowledge is key to making smart choices and boosting your wealth.

Common Mistakes to Avoid in Investments

A common mistake investors make is letting emotions drive their decisions. When the market goes up or down, it’s easy to feel excited or scared.

This can lead to buying high or selling low. Staying calm and sticking to your plan is crucial for long-term success.

Another mistake is failing to do proper research. Some people jump into investments without understanding what they’re buying.

Always take time to learn about the asset and the market conditions before investing your money.

Finally, neglecting to diversify is a major error. Putting all your money into one stock or asset can be risky.

By spreading your investments across different sectors, you protect yourself from significant losses and improve your chances of steady growth.

Adapting Your Strategy to Achieve Lasting Results

Investing is not a one-time decision but an ongoing process that requires regular review and adjustment.

Market conditions, personal goals, and risk tolerance can change over time, making it essential to revisit your strategy periodically.

By monitoring your portfolio’s performance and staying updated on economic trends, you can make informed changes that keep you on track toward your objectives.

This adaptability not only protects your investments but also positions you to take advantage of new opportunities as they arise.

Conclusion

Smart investment strategies are built on a foundation of knowledge, planning, and discipline—three pillars that determine the difference between financial growth and missed opportunities.

By clearly defining your short-, medium-, and long-term goals, diversifying effectively across asset classes, and using reliable tools, you build a solid financial foundation.

Avoiding common pitfalls further strengthens this framework for sustainable wealth creation.

True success in investing isn’t about chasing quick wins or reacting impulsively to market swings.

It’s about making consistent, well-researched decisions that align with your personal risk tolerance and long-term vision.

This means staying informed about economic trends, regularly reviewing and adjusting your portfolio, and taking advantage of opportunities when they align with your strategy.

With patience, adaptability, and a commitment to continuous learning, you can transform your investments into a reliable vehicle for financial security.

Over time, disciplined execution and strategic adjustments will not only protect your capital but also allow it to grow steadily, ensuring that your money works for you—now and in the future.